Pressure growing for Federal Government to adopt targeted cost of living relief

Monday 18 November 2024: Foodbank Australia insists the federal government can no longer ignore the mounting pressure to adopt an incentive for farmers and small to medium businesses that has the potential to halve food waste by 2030 and provide the equivalent of 100 million nutritious meals every year to food relief organisations, something that is vital in this current cost of living crisis.

For more information about the National Food Donation Tax Incentive with the full proposal and communications resources, click here.

Tax Incentive Bill could halve food waste by 2030

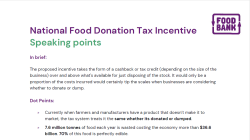

The Tax Laws Amendment (Incentivising Food Donations to Charitable Organisations) Bill 2024, introduced by WA Senator Dean Smith, aims to incentivise small to medium food producers, such as farmers and growers, to donate excess fresh fruit and vegetable to charitable organisations like Foodbank, critical in meeting the rising demand of those accessing food relief in Australia.

Senate rejects critical food donation Tax Incentive Bill

In the same week that two government reports were handed down, both recommending the adoption of the food donation tax incentive as a targeted non-inflationary measure to address cost of living pressures, the Senate economics committee has rejected the Bill that would have brought the incentive to life.

Foodbank Australia believes that ignoring the advice of industry experts, ultimately fails our agriculture sector and the many Australians struggling to put food on the table despite growing evidence and overwhelming support for the incentive.

Foodbank CEO: Rejection a blow to farmers and families in need

According to Foodbank Australia CEO, Brianna Casey AM, the rejection of the bill is a blow to the food relief organisation’s efforts to provide consistent, nutritious food relief to millions of people experiencing food insecurity.

“At a time when 3.4 million Australian households are struggling to put food on the table, this decision is not just perplexing but disheartening for hardworking farmers and growers who desperately want to do more to help get food on the tables for those doing it tough.

“The Federal Government has the opportunity to make a positive difference and to act on the numerous recommendations coming from the Senate, House of Representatives and Victoria, South Australia and New South Wales state governments, all calling for this smart policy to be adopted. We urge the federal government to adopt the tax incentive which would deliver an immediate increase in healthy food to struggling families weeks out from Christmas,” Casey said.

Stay up to date

Sign up using the form below to receive updates on the progress of the proposal and information on what you can do to support it

Contact us

Contact us Log in

Log in